EU urged to set a binding 11% green gas target

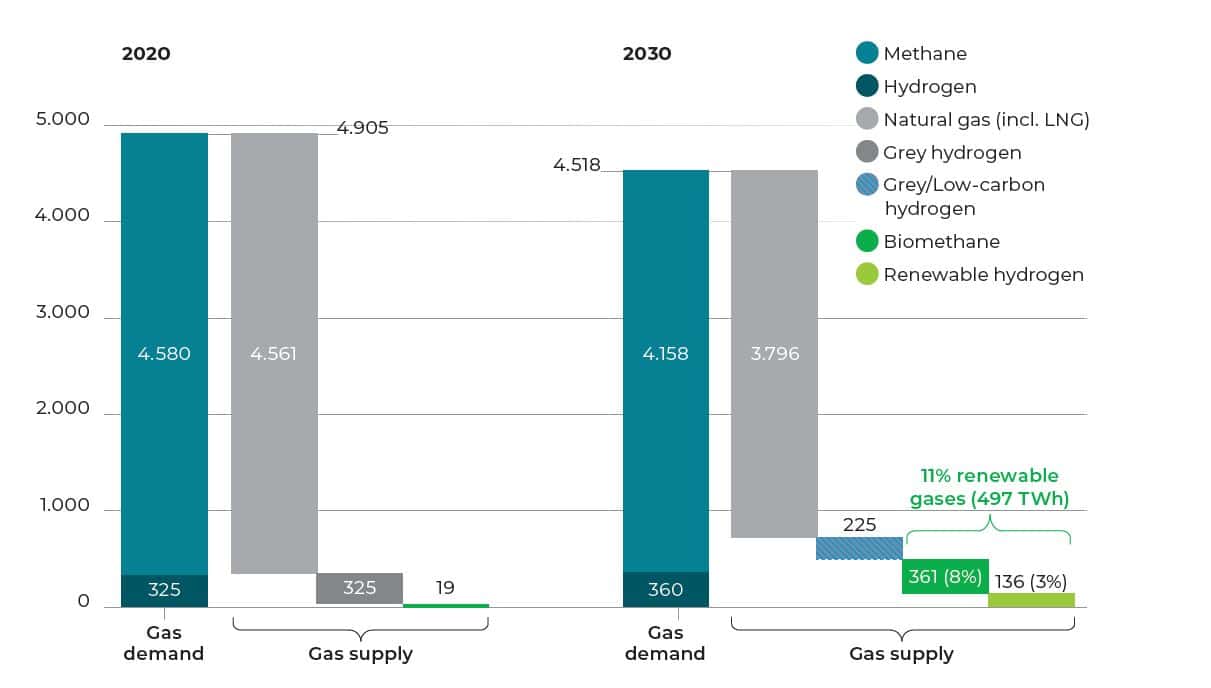

The EU is being urged to set a binding target for 11% green gases in the grid by 2030, amounting to around 500 TWh.

Under the proposal, biomethane will deliver 360TWh (8%) and renewable hydrogen 140TWh (3%), in line with what the European Commission called for in its recent hydrogen strategy. The different levels of contribution to the 11% total reflect the readiness of the technologies; the biogas sector is mature and ready to scale while the hydrogen sector is nascent.

The call has been issued by Gas for Climate Coalition, a group of 10 leading European gas transport companies – Enagás, Energinet, Fluxys, Gasunie, GRTgaz, ONTRAS, Open Grid Europe, Snam, Swedegas, and Teréga – and two renewable gas industry associations Consorzio Italiano Biogas and European Biogas Association.

In a policy paper commissioned from the international consultancy group Guidehouse, the Coalition call for the target to be enshrined in RED II (Renewable Energy Directive) legislation (see Possible Article to Include in RED II below).

There’s no net zero without green gases

The paper says achieving the EU’s target of reducing GHG emissions by 55% by 2030 ‘will be challenging’ and reaching the net zero by 2050 target ‘will become highly unrealistic’ without enhanced support for green gases.

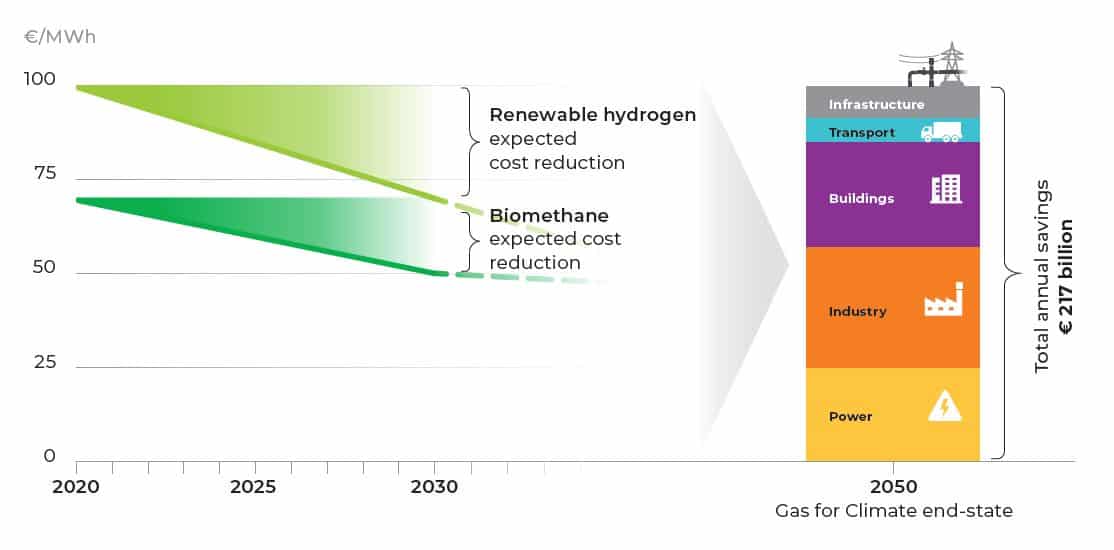

A binding target for green gases to 2030, with a commitment to further support out to 2050, would give certainty to investors, producers and end-users, and bring the costs down.

The principle is proven by the wind and solar sectors which benefitted from such a target for renewable energy being enshrined in RED I in 2009. The target for green gases should adopt the same mechanism, allowing for differentiated targets among nation states and co-operative mechanisms to achieve the 11%, reflecting different starting points and local conditions.

The paper says funding to incentivise green gases should come from the recently agreed Multiannual Financial Framework (MFF, ~ €1,000 billion from 2021 to 2027) and the Next Generation EU fund (€750 billion). An estimated €550 billion will be set aside for climate action.

However, it also highlights that savings from ‘using existing infrastructure and realising the benefits of renewable and low-carbon gases amount to over €200 billion annually by 2050’.

Biomethane, ready to scale

The paper emphasises that the biogas sector is ready to scale and deliver immediate cuts in GHG emissions and other environmental services. Currently the EU AD fleet delivers around 0.5% (23 TWh) of the gas consumed in Europe and ~4% (170 TWh) in CHP units.

The report says the biomethane share could be increased to 3% in the short-term if part of the existing fleet – predominantly producing electricity – upgraded to produce biomethane.

The paper says, “Biomethane has multiple benefits. It is a renewable gas resulting in high GHG savings due to the short carbon cycle of biomass feedstock. It is fully compatible with the existing gas grid, can improve waste management, supports rural economies and has the ability to generate negative emissions.”

And, “Biomethane production through anaerobic digestion is a proven and market-ready technology with little associated technological risks. It can be made available quickly, provides storable and dispatchable energy and allows for the decarbonisation of high temperature heat.”

The ability to create negative emissions is significant because almost all authoritative climate change scenarios show that the world needs substantial negative emissions to achieve net-zero GHG emissions and keep global temperature increase well below 2°C.

A safe investment

Alongside the binding target the report suggests the sector could be incentivised in other ways – through a high CO2 price, proper implementation of the waste hierarchy, or by basing EU vehicle emission reduction regulations on ‘well to tank’ emissions rather than tailpipe emissions.

The Coalition says the feedstock is available and that in the long-term biogas itself can be used as feedstock to produce hydrogen and as platform for the development of fuels for aviation and shipping and further refining in the chemical industry.

In other words, a safe investment – a much needed one in the short term with the ability to deliver viable decarbonised products in the long-term.